SEATTLE — Alaska Air Group (NYSE: ALK) yesterday reported financial results for the first quarter ending March 31, 2024, and provided outlook for the second quarter ending June 30, 2024.

I want to recognize Alaska’s employees for their uncompromising prioritization of safety, for taking great care of our guests, and for delivering strong performance in the first quarter,” said CEO Ben Minicucci. “Despite significant challenges to start the year our results have far exceeded initial expectations. Thanks to thoughtful capacity planning, network optimization, and diligent cost control, we are well positioned to carry our strong performance into the second quarter and beyond.”

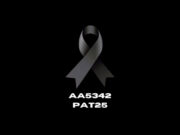

Impact of Flight 1282:

Air Group’s first quarter operation and results were significantly impacted by Flight 1282 in January and the Boeing 737-9 MAX grounding which extended into February. The Company has received $162 million in initial cash compensation from Boeing to address the financial damages incurred during the first quarter.

The table below illustrates the financial impact of the Flight 1282 accident and 737-9 MAX grounding compared to the three months ended March 31, 2023:

Financial Results:

- Reported net loss for the first quarter of 2024 under Generally Accepted Accounting Principles (GAAP) of $132 million, or $1.05 per share, compared to a net loss of $142 million, or $1.11 per share, for the first quarter of 2023.

- Reported net loss for the first quarter of 2024, excluding special items and mark-to-market fuel hedge accounting adjustments, of $116 million, or $0.92 per share, compared to a net loss of $79 million, or $0.62 per share, for the first quarter of 2023.

- Repurchased 561,086 shares of common stock for approximately $21 million in the first quarter.

- Generated $292 million in operating cash flow for the first quarter.

- Held $2.3 billion in unrestricted cash and marketable securities as of March 31, 2024.

- Ended the quarter with a debt-to-capitalization ratio of 47%, within the target range of 40% to 50%.

Operational Updates:

- Agreement to purchase Hawaiian Airlines for $18 per share was approved by Hawaiian shareholders. The proposed combination remains subject to regulatory approval.

- Ratified a five-year collective bargaining agreement with approximately 1,000 Alaska Airlines employees represented by AMFA.

- Completed inspections of all 737-9 MAX aircraft and returned the fleet to service in February.

- Enhanced quality oversight program at the Boeing production facility to validate the work and quality of our aircraft as they progress through the manufacturing process.

- Received two E175 aircraft during the quarter, bringing the total in the Horizon fleet to 43.

Commercial Updates:

- Launched partnership with Bilt Rewards, which adds Alaska’s Mileage Plan as a transfer partner and later in 2024 will allow Alaska Airlines Visa Signature® cardholders to earn 3x miles when paying rent via Bilt.

- Announced growth plans out of Portland to provide guests with more travel options, including 25% increased capacity and a new daily nonstop flight to Atlanta, beginning later this year.

- Announced new daily nonstop service between Santa Rosa and Las Vegas, which will be Air Group’s seventh destination from Sonoma County.

- Introduced Alaska Access, a monthly subscription program for price-conscious travelers that offers Wi-Fi vouchers, early access to sales, and a personalized fare page.

Featured photo credit: Alaska Airlines