Imagine taking off on as PIC of a passenger flight without mapping out your route, waypoints, fuel requirements, risks, etc. How successful do you think you would be over a year (much less several decades)? Chances are you wouldn’t even consider it!

So here’s a question: If you wouldn’t do it for a single leg of a trip, why would you go through your entire financial life without a plan? Building a financial plan is easier than you think, and I can tell you from experience that those who have a plan outperform and build wealth faster than those who do not.

So let’s build a plan for you!

Why a financial plan is critical

A plan brings the future into the present so you can take action now. It also makes the uncertain certain and a plan is the single most powerful tool for accomplishing a goal.

Look at these statistics from the Employee Benefit Research Institute’s annual survey and see where you fall:

- 86% have not concretely figured out the amount they need to have set aside for their financial goals

- Only 21% feel confident they will be able to live comfortably in the future

- Of the 79% that don’t feel confident, less than 5% have a real financial plan

What does this mean? Simply that very few people have any sort of plan.

Five things a financial plan does for you

A financial plan puts you in control of your money and your financial life, and accomplishes five things:

Creates awareness. As you go through the process, you’ll gain awareness of what you need to do to generate the outcomes you want and need.

Starts with the end in mind and gives you daily, weekly, and monthly steps to get there. Once you identify your desired outcomes, work backwards to determine the action steps you need to take now, daily, weekly, monthly, and so on.

Turns unknowns into knowns and the uncontrollable into the controllable. Going through the planning process uncovers risks you didn’t know existed and allows you to turn seemingly abstract targets into daily and weekly “controllables” that move you to your goals.

Keeps you motivated by accomplishing regular wins. When you build your plan, you build in easy “wins” each day or week so you see and feel the accomplishment. This keeps you motivated and charging forward.

Allows you to answer “yes” to three questions.

- Are you perfectly clear on your financial goals and desired outcomes?

- Are you just as clear on what you need to do each day to get there and succeed?

- Do you have a system in place to stay motivated and on track?

Good news!

The good news is that creating a financial plan is not only easy (when done right), but it enables you to focus on the actions you can take to reach your financial goals.

How to build a high quality financial plan on your own

Just as you need to be well-informed about every aspect of your flight, if you are to build a plan, you need to be well-informed about every aspect of your financial life.

As you go about building your plan, realize that you don’t have to do everything at once – you can break it up into smaller tasks and tackle it over a period of days or weeks.

Twitter: @Pilot_Planner

Email: andy@airspeedandmoney.com

LinkedIn: linkedin.com/in/pilotplanner

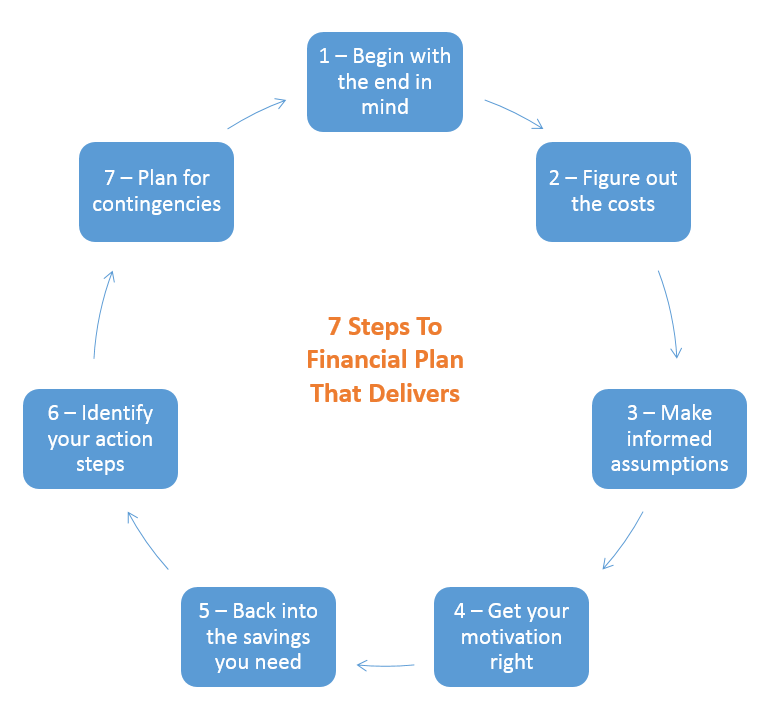

Step 1 – Begin with the end in mind —your financial objectives

What are your major goals, both based on timeframe and purpose? Take some time to write out the following:

- Short-term goals (less than two years)

- Medium-term goals (two to five years)

- Long-term goals (five years plus)

- Retirement at age 65 (what does it look like?)

- Other goals (children’s education, home purchase, vehicles, vacations, etc.)

Step 2 – Figure out the cost

After you have your goals, you’ll need to figure out three things.

- Identify how much each of these items would cost, in today’s dollars

- Figure out how much they will cost in the future when your goal arrives

- Determine how much money you need to fund those goals when they are to occur

Step 3 – Make informed assumptions

Much of your plan will rely on the types and quality of your assumptions, so take care in this step! Consider the following:

- Investment returns for short, medium, long-term, and retirement funds

- The cost of living increase (inflation) to assume each year

- What will your family and responsibilities look like? Will they change?

Step 4 – Get your motivation right

To succeed, you must stay motivated, so consider the following:

- What will happen if you do reach these goals? How will you feel?

- What will happen if you do not reach these goals? How will that feel?

Step 5 – Back into the savings you need

Once you have the cost and timeframe of your goals along with the assumptions, you can “back” into what you need to be saving each month and each year.

How? Google the phrase “Bankrate savings goal calculator” and enter your financial goals and assumptions from above. Once you do that, you’ll see how much you need to save monthly, weekly, and daily to get to your goals.

Step 6 – Identify your action steps

Action is what separates the successful from the unsuccessful. Once you have your plan, it’s time to put it to work.

- Identify the three activities that you need to do every week to be on track

- Identify the one activity you need to do each day to be on track

- Make a list of actions that will propel you towards your goals and take them!

Step 7 – Plan for contingencies

Every pilot knows that a plan changes almost as soon as the wheels are off the ground. The same is true in your financial life, so make sure you take time to make a list of things that could go wrong along the way and have a backup/contingency plan to address each.

Final thoughts

Creating and following a financial plan will help you protect against the risks you face and outperform those without a plan, and thus, build wealth faster. It creates greater awareness, gives you checkpoints along the way, and regular “wins” while ensuring you know exactly what you need to do to accomplish your financial goal.

If you want a second set of eyes or expert help in creating a proper plan, look for someone who:

- Is a fiduciary 100% of the time (i.e. he/ she has a legal obligation to act in your best interest)

- Is a Certified Financial Planner™ (the ATP certificate of the financial planning world)

- Is well versed in the issues airline pilots face (especially with respect to furlough/bankruptcy/industry risk planning)

- Is comfortable to work with

Creating a financial plan is a liberating experience and the single most important step you can take to mastering your money and living the life you want. Get started today and you’ll be way ahead of most!

P.S. Do you want a FREE copy of the book Million-Air: Strategies For Pilots To Build Significant Wealth? Head to airspeedandmoney.com/freebook and enter your email!