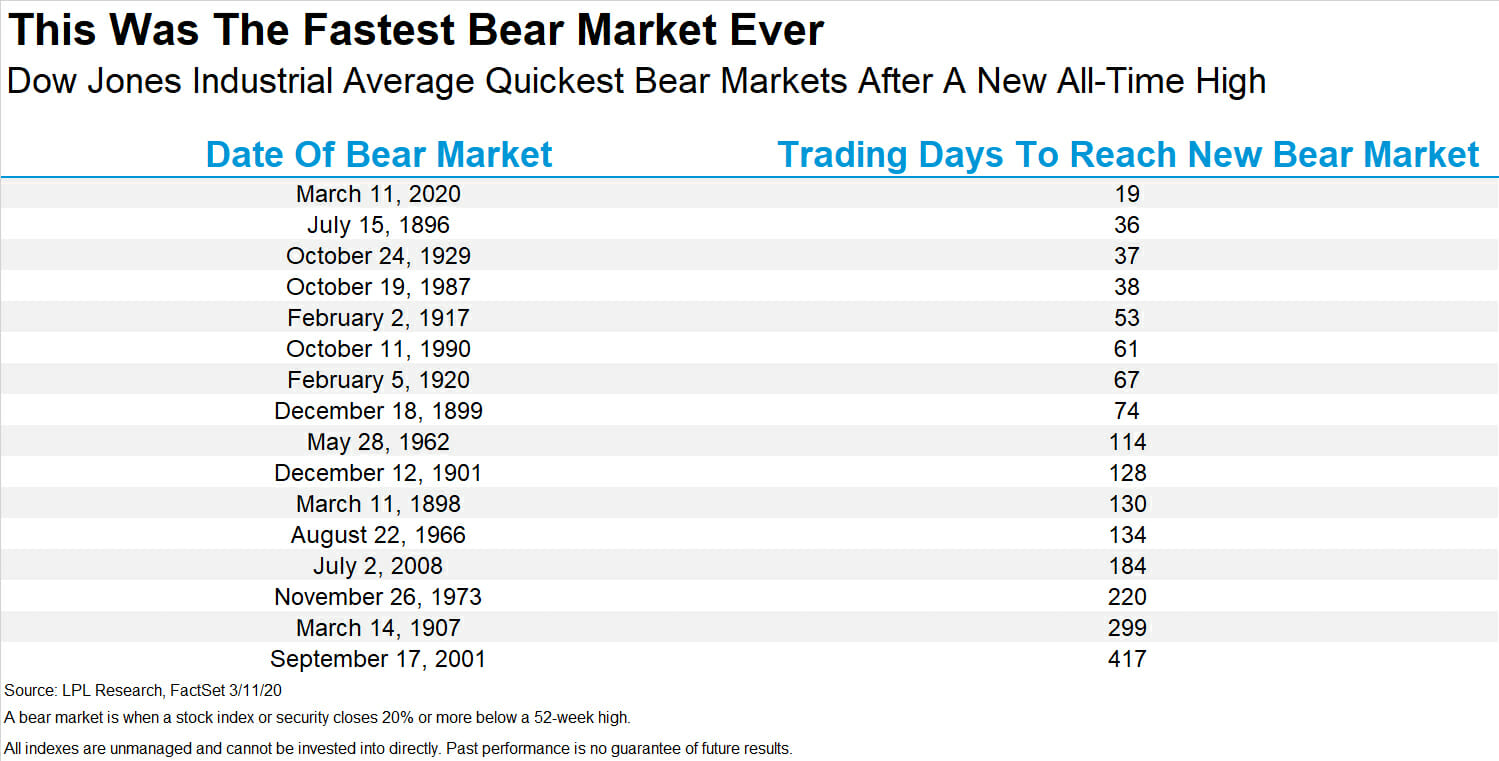

To say market activity has been attention-grabbing over the last few weeks would be an understatement. Historic volatility continues, with the Dow Jones Industrial Average officially setting its fastest move from a new all-time high to a bear market (down 20% from the highs) in the 124-year history of the index. It took only 19 days for this to take place, which is far and away a new record.

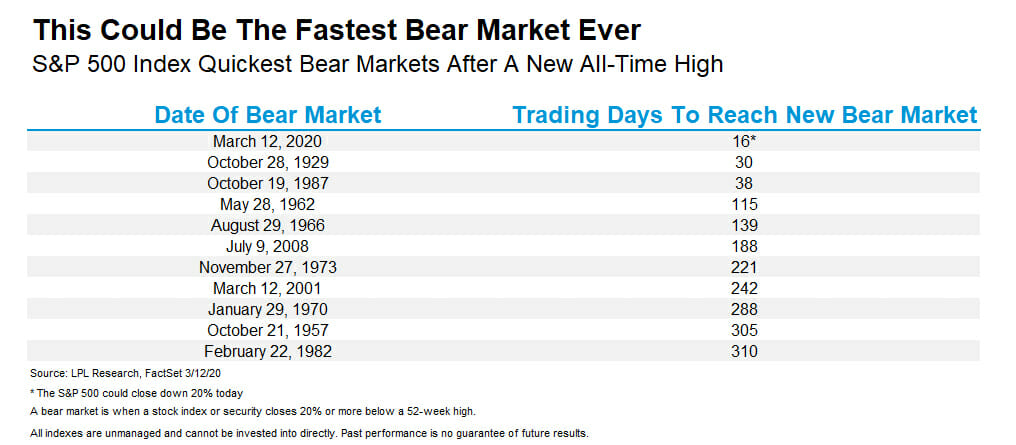

Not to be outdone, the S&P 500 Index is set to close down 20% from all-time highs today, doing this in only 16 days

According to BTN Research:

- After closing at an all-time high of 3386 on 2/19/20, the S&P 500 fell 26.7% to close at 2481 on 3/12/20.

- The fall was the 4th drop of at least 15% but was the first decline of at least 20% (the level required to be defined as a “bear” market) that has occurred during the bull market that began on 3/10/09.

- The three other “near-bears” ended on 7/02/10 (off 16.0%), 10/03/11 (off 19.4%) and 12/24/18 (off 19.8%).

This goes along with:

- The bull market for the S&P 500 that began on 3/10/09 is now officially over.

- That bull lasted 131 months (2,756 trading days – one month short of 11-years in duration).

- The S&P 500 peaked on 2/19/20 at 3386, gained +529% (total return) or an annualized gain of +18.3% per year (total return), and set 255 all-time closing highs.

- It was the 11th (and longest) bull since the end of WWII, producing the second largest overall gain.

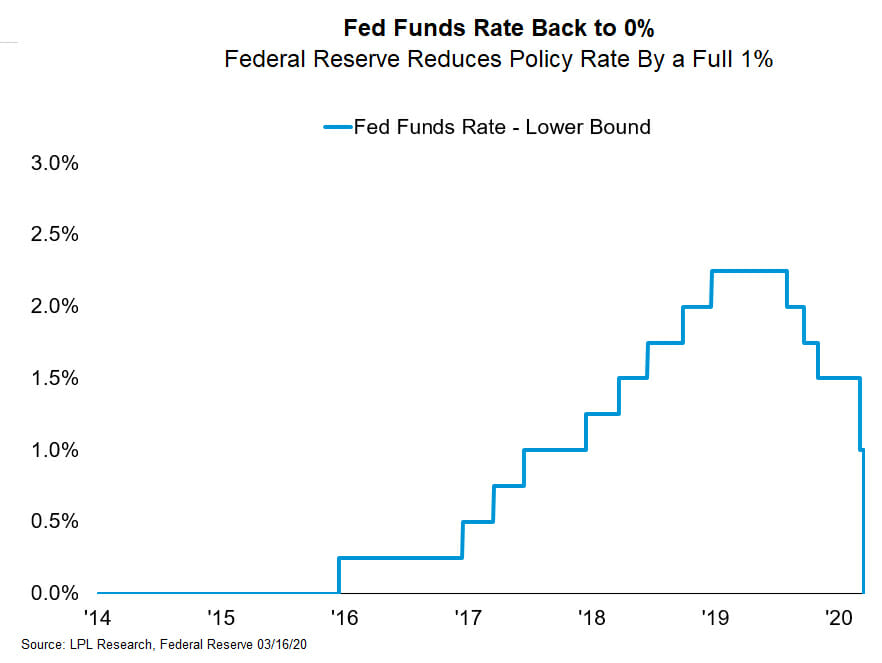

The Federal Reserve (Fed) surprised markets by holding its March 17 scheduled meeting a few days early and introduced a wide range of provisions. Those provisions are intended to add liquidity, increase credit availability, lower the cost of borrowing, and eventually support the economy’s recovery from the impact of COVID-19.

Usually, Fed actions are fundamentally about setting the level of interest rates, and the Fed certainly made a statement there. As shown in our LPL Chart of the Day, the Fed lowered its policy rate a full 1% to a range of 0 to 0.25%, the first time the Fed has made a move that large in a single meeting since the savings and loan crisis of the 1980s. The policy changes to increase liquidity and relieve funding stress, likely offering a more important short-term impact.

The measures to add liquidity included:

A new quantitative easing program (QE) in which the Fed committed to buying $700 billion in bonds.

Making it easier for a bank to use its discount window, a secondary source of funding.

Working with other central banks to make sure that U.S. dollar demand could be met.

Temporarily reducing bank reserve requirements to zero.

With the Fed’s policy rate now at zero, market participants may also be expressing concern that any future policy impact may be limited. Our view is that we may have come to expect too much from the Fed and other central banks. The Fed has always been very good at creating liquidity when needed (the main reason it was created), and has usually been effective at setting rate levels, but it cannot change the underlying fundamental cause of recessions.

The Fed, of course, has no influence over the spread of COVID-19 or the immediate slowdown in economic activity that it’s causing.

I am often asked how I would suggest navigating this crisis. Here are a few thoughts:

- Get your personal finances in order. The first step is working towards having 3-6 months of expenses in a checking or savings account. The purpose of this is so your family has a liquid backstop in the event it is needed.

- Work to pay-off any and all debts. Lessening the total balance(s), you will likely feel an increased sense of calm should find yourself in an unfortunate situation.

- Increase your personal saving rate to the highest level you can afford. A high savings rate will allow you to have funds pre-designated when you feel there is an opportunity.

- Continue to educate yourself on the market and personal finance matters. This can be relatively easy in this day and age. There are many reputable and respected online websites offering free educational tutorials. Take an online adult education class through a local college offering financial knowledge.

- Put this knowledge into action by forming your own beliefs and processes for navigating towards your financial independence. This all works to avoid making an emotionally driven decision.

- Should you NOT have the TIME, KNOWLEDGE and DESIRE to do the above, please seek someone who can help guide you.