Last month we looked at the three success habits that financially success people follow. This month we will look at the four biggest financial mistakes I’ve seen over the last 15 years and how to avoid them.

Mistakes are often more costly than we think, especially in our financial lives. Not only do they cost us money, but they cost us lost time – time better spent building wealth and doing things we care deeply about.

If you can follow the three success habits laid out last month and avoid the four mistakes we talk about this month, you will be well on your way to creating incredible financial success.

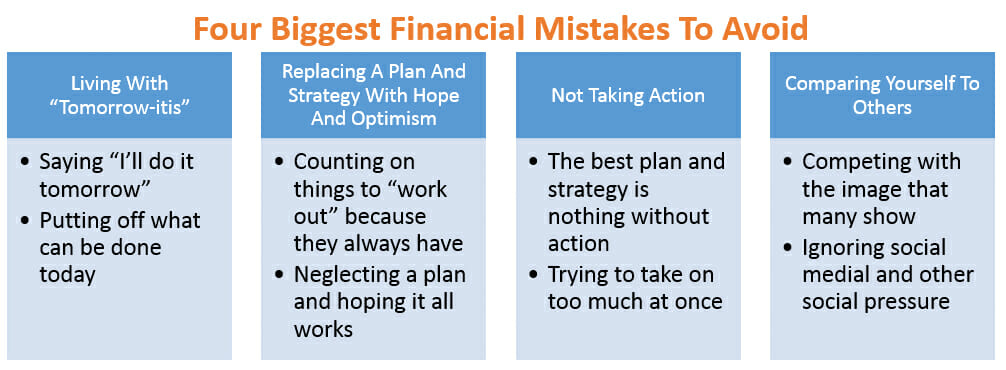

Let’s dive into the four biggest financial mistakes and how you can avoid them.

Let’s dive into the four biggest financial mistakes and how you can avoid them.

Mistake #1 – Living with “tomorrow-itis”

By far, the number one mistake I see people make in their financial lives, is living with what I call “tomorrow-itis.” Tomorrow-itis is simply saying, “I will do it tomorrow,” or “It will be taken care of tomorrow,” or any version of “I’m not going to do it today because I will do it tomorrow.” As you might expect – and likely have experienced at some point –tomorrow never comes. The major problem with living with tomorrow-itis is that we delay action (more below). To avoid living with tomorrow-itis we need to make sure we take some action every day to move toward our goals. Doing so will keep you on the path to accomplishment.

Mistake #2 – Replacing a plan and strategy with hope and optimism

Hope and optimism are two very powerful and productive feelings to experience, but acheive nothing without a plan and strategy. When people simply hope that something will work out or expect that it will because “it always has,” they end up in a hazardous situation because they are not directing and designing the outcomes themselves.

I can tell you with absolute certainty that the people who live their financial lives by design are far more successful than those who live their financial lives by default! To make sure you’re operating by design and not by default, have a plan and strategy in place. Every flight goes better with a plan and every pursuit of a financial goal goes better with a plan, as well. Your plan does not have to be complicated. It simply needs to outline what must happen and what actions you need to take to reach your goal. Then, make sure you’re taking daily action on that plan.

Twitter: @Pilot_Planner

Email: andy@airspeedandmoney.com

LinkedIn: linkedin.com/in/pilotplanner

Mistake #3 – Not taking action

Action is the most crucial part of reaching your financial goals. Why? Because everything is tied to taking action.

The best intentions, the best plan, and the best goals in the world come to nothing without action. Action is what separates the financially successful from the average and the unsuccessful. So how do you become a master at taking action in your financial life? Simply list all the things you could do – action-wise – to reach your financial goals and start small.

Don’t try to solve all your problems and challenges on day one, but simply break each major action into smaller actions and get moving by taking one or two small actions every single day. If you take two small actions every single day in the direction of your financial goals, you will be taking over 720 actions every year. If you’re doing that, it will be very difficult not to move toward financial success!

Mistake #4 – Comparing yourself to (your image of) others

Why is comparing yourself to others such a major financial mistake? Because, despite the lifestyle you might see your friends enjoying on social media, the majority of Americans are broke. In this country, 76% live paycheck-to-paycheck (Bankrate study) and over 60% couldn’t come up with $1,000 in an emergency (GoBankingRates study). Social media and the constant news flow make it easy to focus on what others are doing, or seemingly have acquired, or have achieved. Often, this causes us to fail to realize it that all that has nothing to do with our lives.

If you compare yourself to the image that others are showing, you’ll likely end up in the same situation. Comparison to others is not only unproductive, but it often does a great deal of damage to your financial life.

So, what does this mean to you? It means, avoid the temptation to compare yourself to others and what others have (or appear to have)! Don’t worry about what’s on social media, worry about what’s in your bank account.

When you’re focusing on yourself and what you can accomplish, you will be miles ahead of everyone else, and at that point, comparisons won’t even matter.

Final thoughts

Taking the time to build the correct habits discussed last month and avoiding the biggest mistakes laid out here are the two critical elements necessary in reaching financial success.

Avoid tomorrow-itis — take care of that which needs (and can be) taken care of today.

Have hope and optimism, but ensure you have a plan and a strategy to back them up.

Take constant actions toward your goals, and remember, action is what separates the successful from the unsuccessful.

While you’re doing these three things, never compare yourself to others – focus on what you’re accomplishing and the actions you can take toward success.

PS – Want a FREE copy of the book on building wealth as a pilot? Go to AirspeedAndMoney.com/freebook and enjoy!