Is one of your resolutions for the year to be more diligent of your family’s finances that are aimed at working toward your financial freedom? As noble as your intentions are, you may become absorbed by life’s demands leading you to forget or forego the financial resolution. In my experience, this is strikingly similar to the way that many investors forget to focus on strategies to protect their investment portfolio(s). We are all well aware that neglecting our investment portfolios can have significant and even catastrophic consequences.

This is especially significant as:

- The richest women in America live ten years longer than the poorest women. ( https://healthinequality.org/)

- The richer you are, the longer you live. The consensus seems to be that wealthy people (of both genders) on average live more than seven years longer than the poor. (https://www.washingtonpost.com/news/wonk/wp/2015/09/18/the-government-is-spending-more-to-help-rich-seniors-than-poor-ones/?utm_term=.03b741213d7a)

- Women report being happier than men and happier people tend to live longer enjoying better long-term health and wealth outcomes. (https://www.brookings.edu/blog/up-front/2016/03/04/some-good-news-for-international-womens-day-women-are-usually-happier-than-men/)

Rewarding investment markets with impressive returns over a period of time can lead to average investors being caught off guard and ill prepared for an unexpected market decline. Inherently, human beings are more comfortable thinking that things will never change. Keep in mind though, that investment markets are cyclical. History demonstrates that financial trends will not continue infinitely.

Education is critical. Remember the adage, “All good things come to an end.” Financially speaking, some endings can be disastrous to your long-term financial objectives, but a practical investment strategy will likely serve you well in good and bad markets. Develop yours guided by information. I suggest beginning with an understanding of your willingness to handle market fluctuations as well as the lifestyle you would like to achieve.

I believe protecting your investable assets for large, unrecoverable losses should be a top priority. High volatility is typically destructive to wealth building. I suggest beginning your investment journey by establishing strategies focused on ways that aim to preserve your hard-earned assets. From my experience advising clients toward their financial independence, you will feel losses more than you will feel gains. Painful feelings may impair you from making rational decisions during times of market volatility. Think of it like the purchase of a vehicle: You would likely purchase a warranty and appropriate insurance coverage in an effort to help mitigate a large loss from an unforeseen event. Most investors aren’t aware that a similar approach can be applied when managing their wealth.

I believe conventional investing wisdom overlooks the nuances of how real world investing actually plays out. An example of conventional investing wisdom is that stocks typically go up over the long-term. History shows that the stock market typically moves in cycles. In the past 120 years, there have been five bull markets and four bear markets. Investment strategies that work in bull markets may not be effective in flat or bear markets. Being aware of potential outcomes, along with what strategies may best suit you in a given market, enables you to feel more confident.

Another conventionally held wisdom is the idea that stocks and bonds tend to behave in opposite ways; when one goes up the other goes down. This notion has enticed many investors to default to a strategy of 60% in stocks (represented by the S&P 500 index) and 40 % in bonds (represented by the Bloomberg Barclay’s U.S. Aggregate Bond Index). This allocation was seen as a safe and easy diversification over time. But history tells us this is not always the case. During the 1970s into the mid-1990s, the exact opposite was true as the Barclay’s Aggregate didn’t perform as the portfolio ballast to riskier stocks.

In developing your investment strategy, educate yourself and consider the end results. This insight will help you derive your own opinion on the economy, investment opportunities, and what you think is an appropriate manner to proceed. Know where to find information and how to use it. To begin, let’s review some data and where to find it. These datapoints are not all-encompassing, rather a starting point in your journey toward your investing PhD.

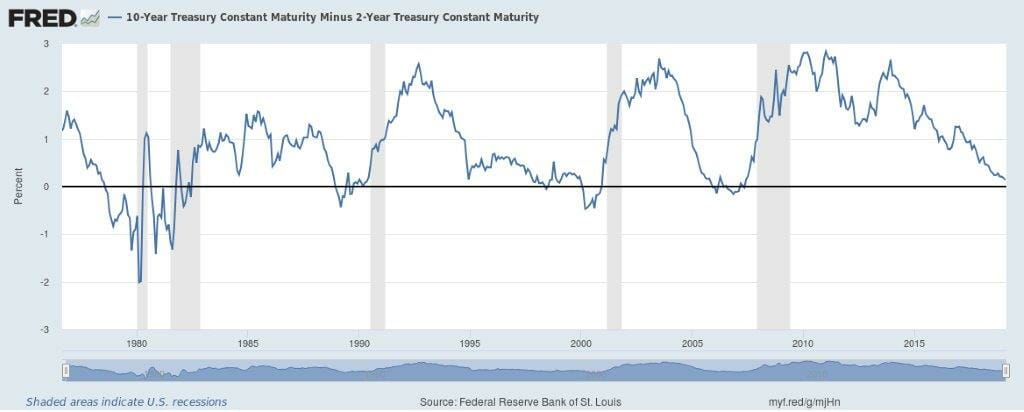

The yield curveis the difference between the interest rates on short term United States government bonds and longer-term U.S. government bonds. Typically, in a healthy economy, the rates on long term bonds will be higher than on short term bonds. The extra yield (aka interest) is to compensate for the risk that economic growth will likely cause an increase in prices (aka inflation). New York Federal Reserve president John Williams said the yield curve inversion is “a powerful sign of recessions.” According to research from the Federal Reserve Bank of San Francisco, every recession of the past 60 years has been preceded by an inverted yield curve.

Starting the week of December 3, 2018, the short end of the Treasury yield curve inverted (2-5 year and 3-5 year) for the first time since 2007. The U.S. Department of Treasury website is a great resource to find the various terms along with their yields. This can be viewed at https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield. The chart shows the “10 Year Treasury Constant Maturity minus 2 Year Treasury Constant Maturity” as of Dec 3, 2018. It’s produced by the Federal Reserve Bank of St. Louis and can be viewed at https://fred.stlouisfed.org/graph/fredgraph.png?g=mjHn.

(Shaded areas indicate U.S. recessions; Source: Federal Reserve Bank of St. Louis)

I believe it is vital to be aware of the market’s historical performance to understand volatility. According to BTN Research, since the end of World War II (1945), the S&P 500 has suffered three bear markets that sustained losses of at least 40%. These bear markets are:

- 48% drop in 1973-1974

- 49% drop in 2000-2002

- 57% drop in 2007-2009

Understanding how different investments move in relation to each other can be valuable. The name for these movements is called correlation. Correlations can range between minus one to one. A perfect positive correlationmeans that the correlation coefficient is exactly one. This implies that as one security moves, either up or down, the other security moves in the same direction. A perfect negative correlationmeans that two assets move in opposite directions, while a zero correlation implies no relationship at all.

A common investment allocation is 60% in stocks (S&P 500 Index) & 40% in bonds (Bloomberg Barclays U.S. Aggregate Bond Index). According to Bradley Krom, Associate Director of Research at WisdomTree, investors have been lulled into a sense of complacency with this allocation. Mr. Krom states that this allocation, “… may feel like they’re diversified between stocks and bonds, the fact is that their portfolio remains dangerously exposed to equity market returns.” Mr. Krom shows that, as of September 30, 2018, the current rolling 12-month correlation between 60/40 and the S&P 500 Index is at 0.99.[1]

Consumer spending is a vital part of the American economy; and thus, a large contributor to Gross Domestic Product (GDP). Though it varies by year, the Personal Consumption Expenditure(aka consumer spending) accounts for approximately 70% of the U.S. economy. Monitoring the underlying drivers of spending can be helpful as you consider the probabilities of future outcomes.

It has become common to use credit cards. If fully paid when the bill is due, it can be an efficient way of purchasing items, but the problem arises when those statements are not paid in full. According to a Federal Reserve report of August 2018, credit card debt in the U.S. peaked at $1.02 trillion in May 2008 before falling off during the global real estate crisis. It eventually hit a low of $832 billion in April 2011. However, credit card debt has now climbed all the way back to a record level of $1.04 trillion.

Auguste Comte wrote, “Demography is destiny.” Logically, as people mature into their retirement years, they tend to spend less than they did in their 20s and 30s. According to the Social Security Administration, 15% of the U.S. population was at least age 65 in 2017. By the year 2030, 20% of the population will be at least age 65. Over that 13-year period, the number of Americans at least age 65 is projected to increase by 44% while the overall U.S. population is forecasted to increase only 11%.

A current event that may have economic and political implications is the United Kingdom’s scheduled exit of the European Union (E.U.) on Friday March 29, 2019 after 46 years of membership. The “Brexit” decision was put in motion with a 2016 vote. After the U.K.’s exit, the E.U. will be comprised of 27 nations. This is just one of many geopolitical tensions that may affect the U.S. and its international partners.

We hold many investment values and beliefs. Rather than trying to predict future market movements, focus on risk. For investors, understanding investment risk is a vital concept as it is a function of loss. For example, the more portfolio risk that is taken, the greater the loss may be when markets move negatively. We tackle this phenomenon by applying educated assumptions in an attempt to avoid catastrophic damage over time. This is in the same vein as virtually every professional field; e.g., a surgeon addresses probability, not certainties. These potential outcomes are based on historical data and events, statistics, trends, sentiment, etc., in an effort to control portfolio risk and avoid permanent loss of capital.

Downside deviationand maximum drawdownare datapoints, among others, that may help with your review. These two isolated downside risk parameters more precisely measure the downside volatility (risk) of a security or fund. I believe these two datapoints are more telling than the more commonly known standard deviation. Standard deviation takes into account both “good” (aka up) movements and “bad” (aka down) movements.

Downside deviationisolates the downside movement by onlycalculating the times when the price falls below a defined minimum acceptable return (MAR). You could set the MAR at “0” if you only want to measure the times when the returns fall below 0, or have the MAR change to match a “risk-free” asset (i.e. three-month T-bills) that moves over time. Maximum drawdownis the percentage loss that an investment incurs from its peak value to its lowest in a given period.

I hope this article provides a strong foundation in your journey developing a thoughtful investment process. Education is powerful and is key as you work toward creating a lifetime of financial confidence.

If you are concerned for your family’s financial future, email me at JAMES.KNAPP@KNAPPADVISORY.COMor view more educational resources at www.KnappAdvisory.com

______________________

[1]How to Diversify a 60/40 Allocation with Dynamic Equities, Bradley Krom, Associate Director of Research, 10/22/2018.

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC. The opinions contained within this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The Standard & Poor’s 500 (S&P 500) is an index of 500 stocks seen as a leading indicator of U.S. equities and a reflection of the performance of the large cap universe, made up of companies selected by economists.

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors.

The Bloomberg Barclays U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed rate taxable fixed income.

The Federal Reserve Federal Funds Rates (Fed Funds) is the weighted average interest rate at which banks lend each other funds held at the Federal Reserve.