There are few vehicles as tax-efficient as a Health Savings Account (HSA). I like to think of HSAs as a ROTH on steroids. As you know, in most cases[1], with a ROTH account you can invest after-tax dollars that grow tax-free and are withdrawn tax-free in retirement.

With an HSA, you can deposit pre-tax dollars that grow tax-free and when withdrawn for qualified medical expenses (QME) are distributed tax-free. An HSA may be the most powerful wealth-accumulation tool available to you. First, let’s review the current rules for HSA accounts.

THE RULES FOR HSA ACCOUNTS

To contribute to an HAS, you must be enrolled in a high-deductible health plan (HDHP) and cannot be covered by any other traditional health plan. For example, if you are covered by Tri-Care, you cannot contribute to an HSA even if you are also enrolled in an HDHP at work. Contribution limits for HSA accounts are indexed for inflation and for 2020, the limit is $3,550 for an individual (compared to $3,500 in 2019) and $7,100 for an employee with family coverage (compared to $7,000 in 2019). If you are 55 or older, you are also allowed an additional $1,000 as a catch-up contribution.

For a medical plan to be considered an HDHP, it must meet the following criteria: the annual deductible for 2020 must be at least $1,400 for an individual and no less than $2,800 for a covered family. The total annual deductible and other out-of-pocket expenses cannot exceed $6,900 for an individual and $13,800 for a covered family (this limit doesn’t apply to out-of-network services). These amounts are also indexed for inflation.

Your contribution to an HSA is not subject to federal income tax, state tax (except in Alabama, California and New Jerset), or FICA taxes if made through your employer’s HSA plan.

Distributions from an HSA are tax-free if used for QMEs of your own, your spouse or anyone who is a dependent on your federal tax return. QMEs can be defined as any out-of-pocket health care cost that would be allowed as an itemized deduction on your tax return, unless you actually received a deduction for that expense. (Otherwise, you would be “double-dipping.”) QMEs can be any medical, dental or vision expense. The premium for your HDHP is not a QME because you are already using pre-tax dollars.

Reimbursement from an HSA for a QME does not need to be taken in the year the expense was incurred (so save all QME receipts), but the QME must have occurred in a year you were covered by an HDHP and you did not receive a tax deduction for the medical expense.

If you have an HDHP, you may not contribute to a Flexible Savings Account (FSA). The good news is that unlike an FSA, an HSA does not have a use-it-or-lose-it provision and it is portable. The money you contribute is yours until you use it and becomes part of your estate if you were to pass. You also do not need to submit “proof” of a QME to withdraw money from an HSA, just save the receipts for the QME in case you are ever audited by the IRS. Another difference between an HSA and an FSA is that with an HSA you can change your contribution rate throughout the year.

If you make a withdrawal from your HSA prior to reaching 65 for a non-QME, the withdrawal is subject to both income tax and a 20% tax penalty. After age 65, the same non-QME withdrawal is subject to income tax only.

Once you go on Medicare Part A, you may no longer contribute to an HSA but, of course, can continue to make withdrawals from your HSA. Most recently, Fidelity estimates that a couple retiring in 2019 at age 65 will incur $285,000 in medical expenses in their lifetime², not including any costs for long-term care.

WHAT SHOULD I CONTRIBUTE TO FIRST?

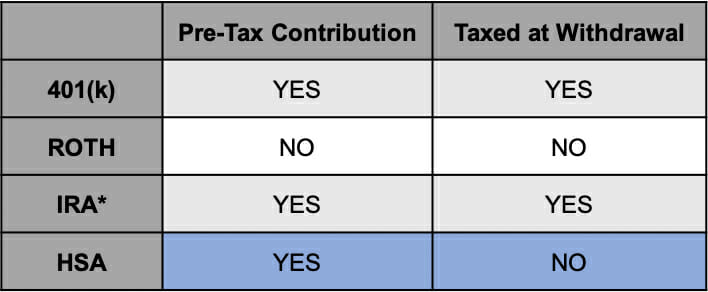

Let’s take a quick look at the tax treatment of these different accounts.

*For the purposes of this discussion, we will assume you are below the income limits that would otherwise exclude you from making these contributions.

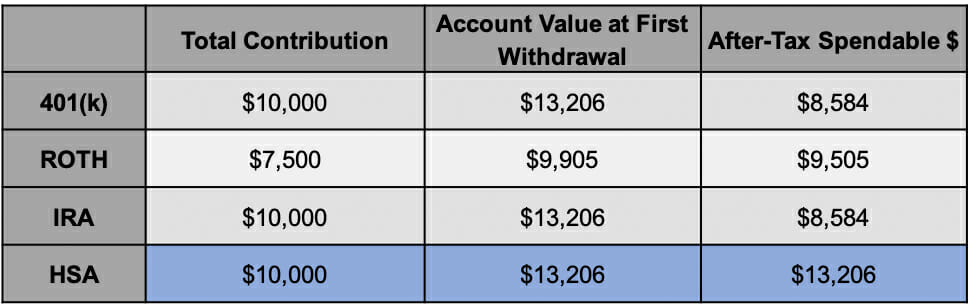

Now let’s take a look at what this could mean to you in spendable dollars in the future. To keep things simple, I will use the following assumptions: 25% effective tax rate, 5% annualized growth, $1,000 yearly contribution, ten years from first contribution to first withdrawal. We will also assume there is no company match to your 401(k).

As you can see, an HSA can yield over 30% more in spendable dollars than any other savings vehicles.

“401(k), ROTH, IRA, HSA…What if I can’t fund them all?” First, I am assuming you do not have a lot of high-interest credit card debt. If you do, that is priority number one. Build a budget, stick to it and get those credit cards paid off. If that means no Starbucks or cable, make the sacrifice; in the long run, you will be much happier.

If you currently are not in a position to contribute the maximum allowable to your 401(k) and an HSA, I would recommend that you contribute enough to your 401(k) to receive the full company match and then contribute as much as you can to an HSA. Please remember that the intent is not to use the money in the HSA to pay current out-of-pocket expenses but to leave the money in your HSA invested for medical expenses incurred in retirement.

As your income rises and you have excess cash flow, contribute the maximum allowable amount to your HSA, then increase your contributions to your 401(k) with the goal of maxing out your contribution ($19,000 in 2019).

SAVINGS PRIORITIES

To review, here is the priority for retirement savings:

- 401(k) contributions sufficient to capture all of your company match

- HSA

- 529 plan contributions (if needed)

- Unmatched contribution to retirement savings plan (401(k), IRA)

Why do we save during our working years? This seems like a simple question. To support ourselves in retirement, of course. Part of that support will require us to pay the many medical expenses we incur during our Golden Years. How better to do this than saving pre-tax dollars, investing them, watching them grow tax-free and withdrawing them tax-free to pay our medical expenses? An HSA is the only current vehicle that allows you to do this.

CONSULT A PROFESSIONAL

Please remember that the following recommendations are somewhat generic, and I have to make assumptions on earnings and tax brackets. For recommendations specific to your situation, please give us a call at (800) 321-9123 or request a call from an advisor, and we will be happy to provide more specific advice.

[1] ROTH contributions are income-dependent. Consult your tax professional for specific advice.

[2] According to an article published by Fidelity Investments in April 2019 titled, “How to plan for rising health care costs.”

Source: Geisler, G. Ph.D. (2016). “Could a Health Savings Account Be Better than an Employer-Matched 401(k)?” Journal of Financial Planning 29 (1): 40 – 48.