Understand and mitigate the unique risks you face as a pilot so you can truly enjoy flying and life!

Last month we talked about the science behind building wealth. One of the surest ways to maintain your wealth is to protect against the risks that could put it in jeopardy.

As a pilot, you face unique financial risks and identifying and managing these risks should be part of your financial life. The good news is that most financial risks can be managed or mitigated away with a little effort as described below.

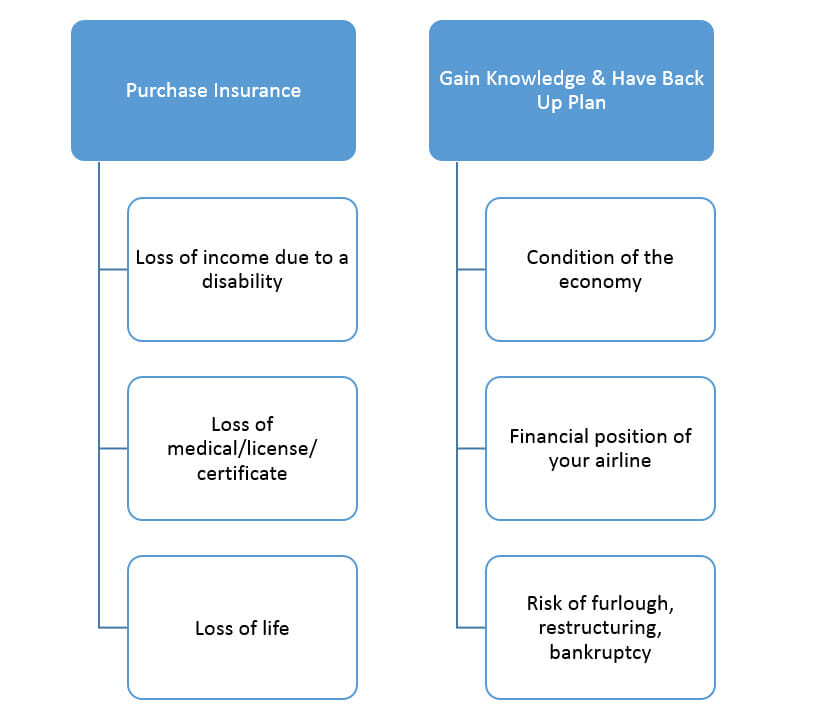

Every pilot faces five risks that must be addressed

Regardless of where you are in your career, you have five financial risks you need to identify and address:

- Becoming sick, hurt, or unable to work

- Losing a medical or your certificate/license

- A loss of life

- Economic and specific airline risk

- Furlough, bankruptcies, and restructurings

Let’s take a look at each risk and what you should do to manage it.

1 – Loss of income due to a “disability”

A “disability” simply means you become sick, hurt, or unable to work. It’s also more likely to happen than you expect (1 in 4 chance according to the Social Security Administration) and different disability insurance policies have different definitions of what “unable to work” means.

To protect against this risk, you need have long-term disability insurance. Most airlines offer disability insurance, so if that’s the case for you, take the time to read the policy and understand what you have. Most importantly, you need to understand what it considered “disabled” and when it would pay out.

If you don’t have it through your airline, you should make it a priority to get some elsewhere. You absolutely cannot afford to go without disability insurance as a professional pilot.

2 – Loss of medical or certificate/license

Unlike the risk of disability, losing a medical or license can happen for reasons other than being sick or hurt. For example, if you require a stint, you may very well be able to do your job, but the FAA may be very hesitant to uphold your 1st class medical right away. The same consideration applies to high blood pressure, substance abuse, depression, or diabetes.

If you have a medical go wrong or an incident and the FAA decides you can’t (or shouldn’t) maintain your 1st class medical or your license, but you don’t meet the requirements to be classified as “disabled,” you need special insurance coverage.

So what should you do? Make sure you’re signed up for your airline’s Loss of License or Loss of Medical coverage, if available. All but the smallest airlines have these options available, so take advantage of them! If by chance your employer does not offer this coverage (very likely in a flight school setting), you should consider purchasing it elsewhere. While not an endorsement, AOPA has some good resources and can lead you to quality coverage.

The last thing you want is to have invested a great deal of time and money obtaining your ratings and building hours and be uninsured, facing a disability or loss of medical/rating event.

3 – Loss of life – if you have a family or debts

No one likes to talk about loss of life, but if you have a family or any debts, you should have life insurance. All reasonably-sized carriers have what’s called “group life insurance,” so make sure you know what you have from your airline. If you don’t have coverage (or enough coverage) through your employer, look to purchase an outside life insurance policy.

For most, “term” life insurance is a better option than “permanent” life insurance. With term insurance, you are guaranteed to be covered for a certain “term” or period of time so long as you pay the premiums. In general, these policies are much lower cost than permanent policies.

So how much should you have if you’re buying term insurance? A rough guideline for how much you need is (90 – your age) x your annual expenses. Any good insurance broker or financial planner can help you calculate the right amount if you have questions.

4 – General economic risk and airline risk

The aviation industry is essential to consumers, businesses, and the broad economy but is also very volatile. It has, and always will, follow the swings of the economy.

This means you should keep an eye on what’s going on in both the economy and the aviation industry. You don’t need to become an expert or focus on every detail, but you do need to be aware of what is going on.

You should also maintain situational awareness of your airline’s financial position. Doing so will keep you on top of how well your company can keep its promises and how it’s likely to perform when times are tough. What’s the best way to do this? Set a Google Alerts (or similar) for your airline’s name and “financial” (ex. “Delta Air Lines Financial”) and you’ll get updates when the company posts them.

5 – Furlough, bankruptcies, and restructurings

Why should a furlough, bankruptcy, or restructuring be on your radar when the current talk is about pilot shortages and record passenger travel? Because, even though airlines have made major improvements in how they are run since 9/11, history does repeat itself.

Furthermore, a lot can happen over a 30+ year career at an airline. Hiring and furlough patterns change quickly when the economy shifts, and you must be prepared with a backup plan.

What’s the best way to be prepared? Have value outside of flying. Make sure you’re learning new skills that are valuable so you can pick right up with other work if you end up in a tough spot. Even better, look to generate additional streams of income so you build wealth faster and reduce your risks altogether.

Bottom line – if it can be insured, it should

We all know that unidentified and unmanaged risks can wreak havoc in the air. The same is true in your financial life. The good news is you can identify and manage these risks, and in doing so, free yourself up to love flying without financial worry!