Investors seem to be fairly optimistic as markets are hovering near or at all-time highs.

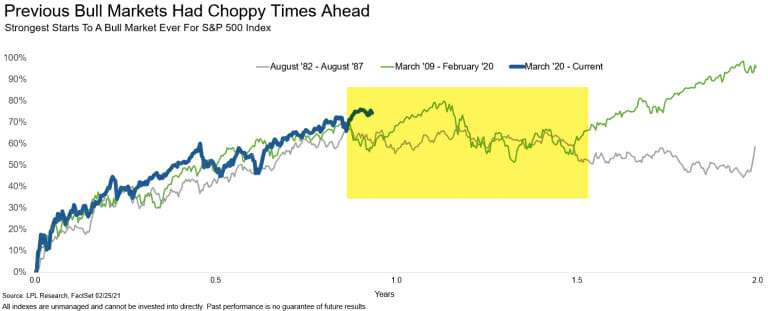

This has caused some investors to wonder if this optimism has gotten ahead of itself raising the risk of a market pullback (or worse). Investors ask if this is a continuation of the bull market, the start of a new bull market or will it lead to a market sell-off?

Yogi Berra said, “It’s tough to make predictions, especially about the future.”

Historians and journalists have the luxury of waiting for time to pass to declare a narrative for a certain time period. Unfortunately, investors don’t have time to wait as the ramifications can be detrimental to your financial progress (aka “flight plan”).

Similar to how pilots prepare flight plans to adjust for dynamic and changing risks, I believe an investor’s primary focus should be on their portfolio risk. Specifically, understanding investment risk is a vital concept as it is related to loss.

For example, the more portfolio risk that is taken, the greater the loss potential may be when markets decline. Investors tackle this phenomenon by applying educated assumptions in an attempt to avoid catastrophic damage over time. This is in the same vein of virtually every professional field, e.g., a surgeon speaking to probabilities, not certainties. These potential outcomes are based on historical data and events, statistics, trends, sentiment, etc., in an effort to manage portfolio risk and to avoid permanent loss of capital.

Albert Einstein said, “Know where to find information and how to use it – that is the secret to success.” Let’s review some recently released data as a starting point. This is not meant to be all-encompassing.

It would seem that the economic recovery is gaining steam. In fact, so much so that the Organisation for Economic Co-operation and Development (OECD) had to raise the U.S. gross domestic product (GDP) forecast for 2021 by more than three percentage points this week (from 3.2% to 6.5%).

Among the world’s largest economies, the OECD raised it economic growth forecast for the United States by the most. But India’s economy – the world’s fifth largest – actually saw the biggest upgrade of 4.7 percentage points. Australia, Canada, and Brazil also saw solid increases of one percentage point or more. On the other side of the coin, France and Italy saw slight downgrades. The OECD only sees 3.9% GDP growth in the Euro area in 2021, well shy of the forecasts for the U.S., Australia, Canada, the United Kingdom, and much of the emerging world. Europe has been slower to open up its economies as its COVID-19 vaccine program has lagged well behind that in the U.S., Japan, or broadly emerging markets right now.

At first glance, these GDP projections can make an investor feel optimistic. Though, it is helpful to appreciate the nuance in the numbers. They are derived from a “base-effect,” meaning the coming year is compared to the previous year. As we all know, 2020 was a challenging business environment so comparing 2021 to 2020 numbers may not provide the full story.

For balance, the weekly jobless claims data continue to show around 730,000 according to the Department of Labor, and continuing jobless claims are around 4.42 million people which are signs of the economic damage that still exists. (Again, not a complete list, but merely to be used as a starting point.)

While it is important to have your investments work to make money, I believe it is more important not to lose money. I believe that through understanding what drives market returns over time, rather than trying to predict future market movements, investors can begin to understand the impact the market has on psychology and investor behavior.

In the short run, stock market movements are completely random; though it is essential to be aware of the evidence and clues presented.

The Knapp Advisory Group is here to be your resource. Contact me at JAMES.KNAPP@KNAPPADVISORY.COM.

James C. Knapp, AIF®, BFA™, CPFA®

Securities and advisory services offered through LPL Financial, a Registered Investment Advisor, Member FINRA/SIPC

The material and opinions expressed in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Portions of the materials have been prepared by LPL Financial.

All index and market data from FactSet and MarketWatch.