As a compensation expert, I’m often asked how comp levels vary between areas with higher and lower living costs. Typically, I give the standard reply, “We’re talking apples and oranges here. Compensation levels are based on the cost of labor, not the cost of living. The two indices often correlate for particular areas but don’t always.” Yet given how much we read and hear about inflation in the current economy, I decided to look at this apples-and-oranges comparison and see what it could indicate.

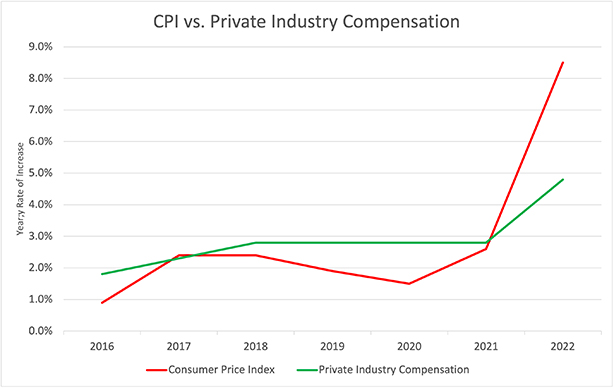

In the graph above, the red line shows the yearly rate increase for the consumer price index (CPI) since 2016, as calculated by the U.S. Bureau of Labor Statistics (BLS). The CPI is probably the most robust statistic we can use to capture the cost of living. The green line on the graph depicts another stat from the BLS, the yearly rate of compensation growth for all workers who are not paid by the government or the military. Note how the two lines remained roughly parallel from 2016 to 2020, indicating that while consumer prices were increasing, the rate of compensation increase was staying constant, i.e., keeping up. The compensation professionals in private industry were looking at the economy and making appropriate yearly adjustments to their companies’ compensation levels. But from 2020 to 2021, even as the CPI began to rise, the rate of compensation increase stayed at previous levels. Perhaps compensation professionals were convinced that the rate of CPI increase was only temporary. Certainly, that’s what government officials were saying at the time. But, from 2021 to 2022, as the rate of CPI increase tripled, compensation professionals understood that corrections were necessary, and we see the rate of compensation increase rising as well, although not nearly at the rate of CPI increase.

This brings us to one of the basic lessons we learn in the world of compensation – pay rates never keep up with the cost of living; they always lag it, both locally and nationally. Companies will never raise compensation rates until they are forced to and will only raise those rates by the minimum required to retain their personnel. That may not be true for all companies in the private space, but it is true for most of them, hence the behavior of the averages we see in the graph.

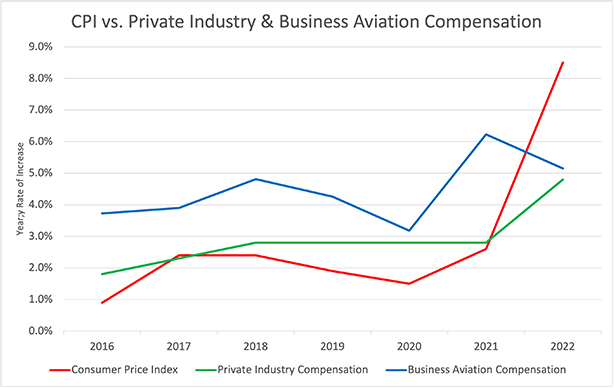

But now let’s look at something important to us in the business aviation industry – the behavior of business-aviation compensation over this same period and in comparison to the two indices we’ve discussed.

Here, the blue line illustrates a multi-survey average of 14 positions common to all corporate flight departments, and the trend here is interesting indeed. From 2016 to 2020, the average rate of business-aviation compensation increase outpaced the rate of increase in private industry by an average of 1.5%, an average of 4% for business aviation versus an average of 2.5% in private industry. But, from 2020 to 2021, while private industry compensation increase remains constant at 2.8%, business aviation compensation increases to 6.23%, more than twice that of private industry. This increase is especially intriguing because this one-year period was the heyday of the COVID-19 pandemic when the economy was reeling, and the airlines were parking aircraft and furloughing pilots. Then, from 2021 to 2022, something odd happens. The rate of CPI growth is tripling, the rate of private industry compensation is (finally) rising, and yet, the rate of business aviation compensation increase falls over a percent to 5.23%, less than half a percent above the rate of increase for private industry at 4.8%. This while the airlines are recovering rapidly and trying to hire pilots to fill the slots vacated by pilots to whom they offered early retirements.

So, what does this mean for business aviation? As a compensation consultant and statistician, two things occur to me. The first option is what I’d prefer to believe – changes and/or anomalies in the data set are driving the dip in the rate of increase. Different organizations responded, or different incumbents occupied the surveyed positions. Promotions and turnover within organizations substantially changed the sample. But I’m not sure that’s what happened. The second option is more troubling and perhaps more likely. The personnel making compensation decisions in business aviation organizations weren’t paying attention. With prices rising and compensation increasing in the general economy, along with the upward wage pressure being generated by higher airline compensation, the need to pay competitively in business aviation has become more important than ever. Maybe there are some folks who didn’t get the memo.

When you live in the world of statistics and data, you rarely pay attention to anecdotes about compensation. When I began consulting work in this field several years ago, I’d talk to clients, and from time to time they’d relate that one of their pilots was complaining about compensation because that person had heard that someone “across the field” was making more money. But today, those anecdotes have become both more numerous and more specific. I regularly hear about pilots being recruited to fly long-range aircraft with compensation levels in the $300,000s. I hear about senior captains poached from other operators to fly the newer, ultra-long-range aircraft with compensation levels well into the $300,000s. The scary thing is that, at the moment, the mid-range 50th percentile data does not support that level of compensation. Why? The data is lagging the market. Just as it always does.

What does this mean for the business aviation managers out there? I’ll give you the same advice I give my clients. The data is lagging and if you pay at the 50th percentile, you’re accepting risk. Pay your personnel in the 75th percentile to stay ahead of the market. Because if you don’t, someone else will.